The Importance of Teaching Kids About Money Early

In today’s fast-paced world, understanding how to manage money is crucial for a successful and stress-free life. From budgeting to saving, the principles of personal finance can set the foundation for a child’s financial future. Teaching kids about money early not only equips them with essential skills but also fosters a healthy relationship with finances. This article explores the importance of early financial education and how parents can implement effective strategies to instill financial literacy in their children.

1. Why Teaching Kids About Money Matters

A. Financial Literacy as a Life Skill

Financial literacy is a vital life skill, akin to reading or writing. In an age where financial transactions are increasingly digital, having a solid understanding of money management is essential. Studies show that financially literate individuals are more likely to make informed decisions, avoid debt, and achieve their financial goals.

B. The Consequences of Financial Illiteracy

Failing to teach kids about money can lead to a cycle of financial illiteracy. Many adults struggle with budgeting, saving, and investing because they were never taught these essential skills. This can result in:

-

Poor Financial Decisions: A lack of knowledge can lead to impulsive spending, excessive debt, and inadequate savings.

-

Stress and Anxiety: Financial issues are a leading cause of stress. Understanding how to manage money can alleviate anxiety related to financial uncertainty.

-

Limited Opportunities: Financial illiteracy can hinder individuals from taking advantage of investment opportunities, buying a home, or planning for retirement.

2. The Benefits of Early Financial Education

A. Developing Positive Money Habits

Teaching kids about money from an early age helps instill positive habits that can last a lifetime. When children learn the value of saving, budgeting, and investing, they are more likely to carry these habits into adulthood.

-

Saving for Goals: Encouraging children to save for specific goals, like a toy or video game, teaches them patience and the importance of delayed gratification.

-

Budgeting Skills: Introducing the concept of budgeting at a young age helps kids understand how to allocate their resources effectively.

B. Building Confidence in Financial Decisions

Children who are educated about money tend to feel more confident in their financial decision-making abilities. This confidence can lead to better choices regarding spending, saving, and investing.

-

Making Informed Choices: With a solid understanding of financial principles, children can weigh options and make informed choices rather than relying on impulse or peer pressure.

-

Understanding Risks: Early financial education helps children comprehend the risks associated with certain financial decisions, such as taking on debt or investing in volatile markets.

3. Effective Ways to Teach Kids About Money

A. Start Early

Teaching children about money can begin as early as preschool. While the concepts may be simplified, introducing basic ideas about money can lay the groundwork for more complex topics later.

- Using Play: Incorporate money-themed games or activities. Games like Monopoly or pretend grocery shopping can introduce concepts like currency, purchasing, and saving.

B. Use Real-Life Examples

Real-life situations are excellent opportunities for teaching moments. Involve your children in everyday financial decisions to help them understand the practical applications of money management.

-

Grocery Shopping: Take your child grocery shopping and give them a budget. This will teach them how to compare prices, make choices, and understand the concept of value.

-

Family Budgeting: Involve children in family budget discussions, helping them see the bigger picture of income, expenses, and savings.

C. Encourage Saving and Goal Setting

Teaching children to save can foster a sense of responsibility and achievement. Encourage them to set financial goals and create plans to achieve them.

-

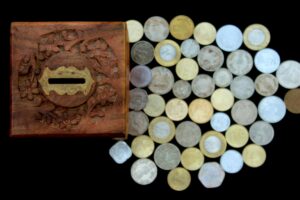

Piggy Banks and Savings Accounts: Provide a piggy bank for younger children or open a savings account for older kids. This tangible representation of savings can motivate them to set aside money regularly.

-

Goal-Oriented Savings: Help them choose a specific goal to save for, such as a new toy. Discuss how much they need to save each week to reach that goal.

4. Introducing Advanced Financial Concepts

As children grow older, gradually introduce more advanced financial topics to enhance their understanding.

A. Understanding Interest and Loans

Introduce the concept of interest to help children understand how borrowing and saving can affect their financial health.

-

Simple Interest Calculations: Teach them how to calculate simple interest on savings or loans, helping them grasp how money can grow over time or increase in cost.

-

Discussing Loans: Explain how loans work, including the importance of interest rates and repayment terms.

B. Investment Basics

When children reach their teenage years, introducing them to basic investment concepts can be beneficial.

-

Stocks and Bonds: Explain the difference between stocks and bonds, how the stock market works, and the idea of risk versus reward.

-

Compounding Interest: Teach them about compounding interest and how investing early can lead to significant financial growth over time.

5. Leveraging Technology for Financial Learning

In today’s digital age, technology can be a powerful tool for teaching kids about money.

A. Financial Education Apps

Numerous apps cater to teaching children financial literacy in a fun and engaging way. Some popular options include:

-

Greenlight: An app that allows children to manage their own money with a debit card, teaching them about budgeting and spending.

-

Savings Spree: A game that teaches children about saving and spending while working toward financial goals.

B. Online Courses and Resources

Many online resources provide structured financial education. Websites and programs offer interactive lessons on various financial topics tailored for kids and teenagers.

6. Encouraging Open Discussions About Money

A. Creating a Comfortable Environment

Encouraging open discussions about money helps demystify financial topics and promotes a healthy attitude toward finances.

-

Family Meetings: Hold regular family meetings to discuss financial goals and successes. This openness can foster a positive attitude toward money management.

-

Encouraging Questions: Encourage children to ask questions about money, budgeting, and investing. Providing honest, age-appropriate answers helps them learn.

B. Role Modeling Positive Financial Behavior

Children learn by example, so demonstrating good financial practices is crucial. Be transparent about your financial decisions and the reasoning behind them.

-

Discuss Financial Decisions: Share your thought process when making significant purchases, helping them understand how to approach similar situations.

-

Managing Mistakes: If you make a financial mistake, discuss it openly with your children, highlighting the lessons learned.

7. Conclusion

Teaching kids about money early is an investment in their future. By instilling essential financial skills, parents can empower their children to make informed decisions, avoid common pitfalls, and develop a healthy relationship with money. From the basics of saving and budgeting to understanding more complex concepts like interest and investing, the earlier children learn about financial literacy, the better equipped they will be to navigate the financial challenges of adulthood.

As a parent, you have the opportunity to shape your child’s financial future. By starting early and using engaging, real-life experiences, you can teach your children the skills they need to thrive financially. Remember, the goal is not just to teach them about money but to help them build confidence in their ability to manage it responsibly.